|

|

|

|

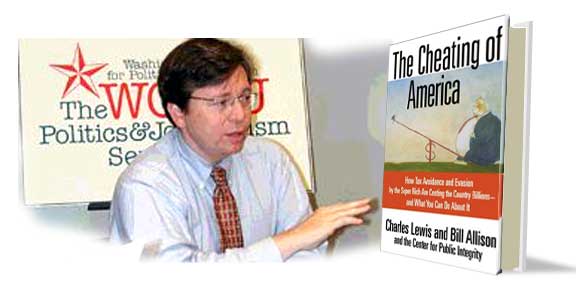

Charles Lewis |

|

|

The Free Market and the Myth of Less Taxes for

People: |

|

| Nipawin - Wednesday, February 6, 2002 - by: Mario deSantis | |

|

|

|

|

|

|

|

economic |

We have shown that the Free Market is a speculative economic gospel for the benefit of the big corporations and fortunate sons; in other words, the Free Market is the realization of the economic philosophy to make money with money through deregulation, privatization, and Free Trade. |

|

|

|

|

government |

Sometime ago we discovered one private branch of the Canadian

Government with the reporting of the Human Resource Development Canada  scandal, where billion of dollars

of federal money were doled out to friends of friends for job creation. A few days

ago, we learnt of another private branch of our government, Industry Canada.

Walter Robinson, of the Canadian Taxpayers Federation

(CTF), reports in one article how billions

of dollars were doled out by Industry Canada to big corporations such as IBM,

Bombardier, Pratt & Whitney, and other household names. In particular,

we learn that Industry Canada has collected a mere two per cent of over $1.6 billion

it has lent in the last five years under the Technology Partnerships Canada

program; however, the collection record becomes 15% for some $3.2 billion lent in

prior years. With the consolidation of the Free Market the privatization efforts

of Industry Canada must therefore be commended. scandal, where billion of dollars

of federal money were doled out to friends of friends for job creation. A few days

ago, we learnt of another private branch of our government, Industry Canada.

Walter Robinson, of the Canadian Taxpayers Federation

(CTF), reports in one article how billions

of dollars were doled out by Industry Canada to big corporations such as IBM,

Bombardier, Pratt & Whitney, and other household names. In particular,

we learn that Industry Canada has collected a mere two per cent of over $1.6 billion

it has lent in the last five years under the Technology Partnerships Canada

program; however, the collection record becomes 15% for some $3.2 billion lent in

prior years. With the consolidation of the Free Market the privatization efforts

of Industry Canada must therefore be commended. |

|

|

|

|

corporations |

The big corporations and fortunate sons have a better life in the United States as they can pursue their American Dream by cheating. The new book The Cheating of America is an investigative project conducted by Charles Lewis, Bill Allison and the Center for Public Integrity. We know that Enron Corp. didn't pay income taxes in four of the last five years, and this is not an isolated case. Corporations have become more important than people, they have taken over governments and therefore democracy and they are now cheating the American people with the complicity of the government. Here are some statements related to the book and extracted from the article Equal Under The Law? by Charles Lewis: |

|

|

|

|

from 28% |

|

| -----------------References: | |

| Lies My Government Continues to Tell Me: New Corporate Welfare Info Validates Successive CTF Reports Denouncing Handouts, Walter Robinson, CTF, January 29, 2002 | |

| Equal Under The Law? What About Enforcement? Charles Lewis, TomPaine.com | |