|

|

|

|

Economic Productivity and the bubbles |

|

| Nipawin - Saturday, February 9, 2002 - by: Mario deSantis | |

|

beserk |

The financial wizards at the Financial Post or for that matter in any of the neoliberal financial media have gone berserk in their search for ever sophisticated business and accurate language. |

|

|

|

|

overvalued |

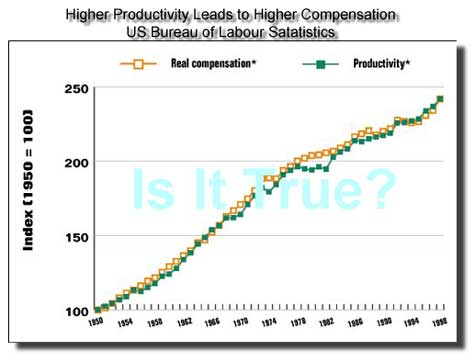

We have explained in some previous articles that the American dollar is overvalued and that the current American stock market could be overvalued by some US$4.5 trillion in an economy of the order US$10 trillion per year. Today, we are at a time of recession with relative lower demand for goods and services, we are not experiencing an inflationary trend, and we are experiencing a relative higher unemployment rate. In accordance to this background I would like you, readers, to ponder the economic relevancy of the following BS financial statements of analyst Jacqueline Thorpe of the Financial Post: |

|

myths |

|

|

|

|

|

bubbles |

By the way, if you didn't understand anything about the above BS financial statements you didn't miss anything as these statements are just bubbles cracked by Jacqueline Thorpe. |

|

|

|

|

|

|

|

|

| -----------------References: | |

| The Biggest BUBBLE of the Free Market: The Myth of the Booming 90ies, by Mario deSantis, January 26, 2002 | |

| Productivity jump in U.S. beats forecast. Up 3.5% in Q4: Gain offsets a 2.3% rise in hourly compensation, Jacqueline Thorpe, Financial Post, February 7, 2002 | |

| "New Economy" Cycle Ends, But Myth Persists, by Dean Baker and Mark Weisbrot, November 27, 2001. "Wage growth [between 1991 and 2001] for a typical worker was a paltry 0.5 percent a year" | |