While policymakers in Washington wrangle over how much progress we've made in Iraq, one thing is clear: The war on terror is making some people rich.

President Bush's military buildup has caused defense-contractor revenue to double, triple and even more during the past five years, and their executives have reaped huge bonuses and stock windfalls as the companies' share prices have jumped.

Take a look:

- CEOs at top defense contractors have reaped annual pay gains of 200% to 688% in the years since the Sept. 11, 2001, terror attacks.

- The chief executives at the seven defense contractors whose bosses made the most pocketed nearly a half-billion dollars from 2002 through last year.

- The CEOs made an average of $12.4 million a year, easily more than the average corporate chief. Since the start of the war, CEOs at defense contractors such General Dynamics (GD, news, msgs), Halliburton (HAL, news, msgs) and Oshkosh Truck (OSK, news, msgs) have made, on average, more in four days than what a top general makes in a whole year, or $187,390.

Defense contractor CEOs are enjoying these big rewards partly because much of the war effort is being outsourced by an administration that believes private companies do things better than the public sector, say researchers at the Institute for Policy Studies and United for a Fair Economy.

"In the most privatized war in history, lucrative opportunities abound for chief executives of defense contractors," says Sarah Anderson of the Institute for Policy Studies.

$19.5 million a year

General Dynamics CEO Nicholas Chabraja tops the list of defense-contractor chiefs who have made the most money during the 2002-2006 defense buildup. Between 2002 and 2006, he pocketed $97.9 million, or an average of $19.6 million a year.

Sales at General Dynamics increased 76% from 2002 to 2006, with significant help from Department of Defense spending. Overall sales increased to $24.1 billion from $13.6 billion, and at least a third of that increase came from higher Department of Defense spending.

Those contract awards helped General Dynamics stock more than double to $80 a share from $39 at the start of 2002. In the same time frame, the S&P 500 Index ($INX) has advanced 28%. The big stock advance allowed Chabraja to collect $21.5 million by cashing out stock options last year. General Dynamics, which supplies technology that goes into combat systems used by several branches of the military, was the fourth-largest Defense Department contractor last year.

David Lesar at Halliburton made $79.8 million, or nearly $16 million a year, from 2002-2006. During this time, Defense Department revenue at his company grew from just 4% in 2001 to 40% in 2004. That year, the company got nearly $8 billion in defense contracts out of total revenue of $19.9 billion.

Virtually all of that money was for logistical support, engineering and construction services provided by Halliburton's Kellogg, Brown and Root division, which was spun out earlier this year to trade as KBR Inc. (KBR, news, msgs). Those contracts helped drive Halliburton stock from $5 at the start of 2002 to more than $40 last year. The gains allowed Lesar to reap $13.6 million just by cashing in options last year, and $14.7 million the year before.

Lockheed Martin Chief Executives Vance Coffman and Robert Stevens together earned $64.8 million from 2002 to 2006. Stevens has also realized more than $19 million so far this year by cashing in options. He replaced Coffman as CEO in August 2004.

Lockheed Martin's Defense Department-related revenue increased from $17 billion in 2002 to $26.6 billion in 2006, a 57% increase. The stock has more than doubled to $100 from $47 at the start of 2002. Lockheed Martin was the top Defense Department contractor last year.

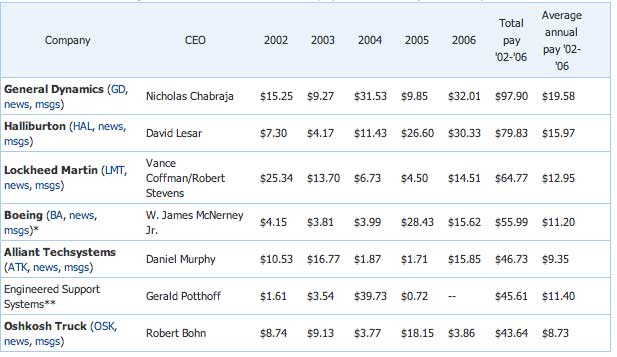

For the rest of the highest-paid defense contractors, see the chart below summing up the pay of those who earned the most. To calculate pay levels, I examined company documents and the Institute for Policy Studies CEO pay database. Pay includes salary, bonus, value realized on exercising and vesting stock options, nonequity incentive plan compensation, long-term incentive stock and "other" pay. Companies had to get more than 40% of their revenue from the Defense Department in one of the past three years to make the list.

Highest defense contractor CEO pay 2002-2006 (in millions)

*McNerney took over in 2005. Before that, pay covers interim CEO James Bell and CEOs Phil Condit and Harry Stonecipher.

**Does not include pay for 2006 because company was taken over.

Sources: Institute for Policy Studies CEO pay database and analysis by Michael Brush of company filings.

The biggest pay raises

While CEOs at the biggest defense contractors naturally got the most pay, those at smaller companies saw some of the biggest increases.

Robert Bohn, chief of Oshkosh Truck, which sells military vehicles, has seen his pay go up nearly eightfold. He earned an average of $1.1 million in 2000-2001, but that shot up to $8.7 million a year on average for 2002-2006. Bohn had his best year in 2005, when he made more than $18 million -- chiefly by cashing in options for a net gain of $14.7 million after his company's stock tripled from the start of 2002.

Oshkosh Truck has seen better profits in part because of a big increase in Defense Department contracts. Back in 2002, the company got 35% of its revenue from Defense Department contracts. That rose to 45% of its $2.26 billion in revenue in 2004 and 50% of its $2.96 billion revenue in 2005. Oshkosh Truck got $4.7 billion in Defense Department contract revenue during 2002-2006, or 38% of its revenue for that time. The contract flow has helped propel Oshkosh Truck stock to $55 a share recently, from $12 at the start of 2002.

The next biggest beneficiary in terms of pay gains was Joseph Kampf, chief executive of Anteon International. The company, which was bought by General Dynamics in mid-2006, provides and maintains information systems, and carries out intelligence and high-tech simulated military training.

Anteon saw its Defense Department revenue almost triple to $939 million last year from $317 million in 2000.

The company's good fortune helped Kampf increase his annual from an average of $643,000 a year in 2000-2001 to $4.2 million a year on average for 2002-2005. He had a bonanza year in 2005, when he netted $7.8 million by cashing out options and earned $9 million all told.

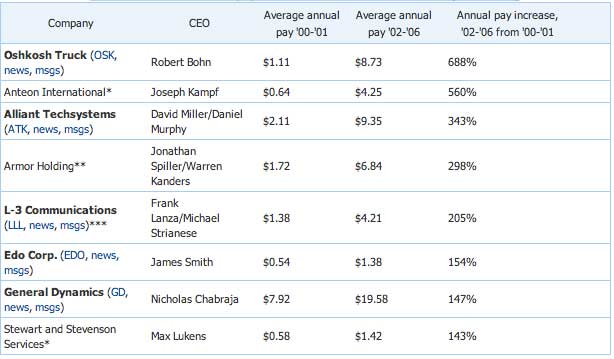

For the other five biggest winners in terms of pay gains, see the list below. CEOs had to work at companies that got more than 40% of their revenue from Defense Department contracts in one of the past three years to make this list.

A spokesman for Edo Corp. (EDO, news, msgs) says CEO James Smith had a relatively modest level of pay, or $193,000, when he took the top position at two companies that merged in 2000 to form Edo. The stock has advanced in part because of a turnaround Smith oversaw, the spokesman says, and his higher income in recent years rewarded him for the turnaround.

Defense contractor CEO pay 2002-2006 versus 2000-2001 (in millions)

Pay includes salary, bonus, value realized on exercising and vesting stock options, nonequity incentive plan compensation, long-term incentive stock and "other" pay.

*Does not include pay for 2006 because company was taken over.

**Spiller's pay for 2000-2002, Kanders' thereafter. The company has also been taken over recently.

***Strianese took over in June 2006.

Sources: Institute for Policy Studies CEO pay database and company filings

Good connections

It may come as no surprise that many of these companies where top managers have done the best also have board members or executives with a military background.

Alliant Techsystems (ATK, news, msgs) Chief Executive Daniel Murphy retired from the Navy with the rank of vice admiral in 2000, following a 30-year career. A director, Martin Faga, served in the Department of Defense as assistant secretary of the Air Force for space.

Oshkosh director Frederick Franks was an Army commander during Operation Desert Storm and retired from the Army in 1994. L3 Communications (LLL, news, msgs) Director John Shalikashvili served as chairman of the Joint Chiefs of Staff from 1993 to 1997. And General Dynamics Director Paul Kaminski served as undersecretary of the Department of Defense for Acquisition and Technology from 1994 to 1997.

But wait a minute. If the stocks of all these defense contractors have done so well, and they have, then why begrudge the CEOs their pay? A 2006 study by the Institute for Policy Studies and United for a Fair Economy titled "Executive Excess 2006: Defense and Oil Executives Cash in on Conflict" cites three reasons:

- Extravagant executive compensation at these companies isn't in keeping with the spirit of shared sacrifice that our country has always called for in time of war.

- Those rich pay levels may drain talent from the military services.

- Third, high profits and above-average pay for execs at defense contractors creates the risk -- or at least the appearance -- that a war might be prolonged for profit motives

The study's conclusion is this: "The vast potential for war profiteering should be of even greater concern during this war because of the extent to which the war and the reconstruction effort have been privatized."

At the time of publication, Michael Brush did not own or control shares of companies mentioned in this column.