|

|

|||||||

|

|

|||||||

The Policy of a US Strong Dollar Is the Policy of Unbridled Greed |

|||||||

| Prince Albert - Monday - November 12, 2007 - by: Mario deSantis | |||||||

Last Tuesday, November 6, I read the article "Down with the dollar" by Dean Baker [1]. In this article, Baker blames the dramatic depreciation of the US dollar on former Clinton's Secretary Treasury Robert Rubin and on Clinton's second administration for having initiated the policy of maintaining a 'strong dollar.' The policy of a strong dollar is the international financial artifice to buy, for a given foreign currency, more foreign currency with one US dollar. In particular, the US policy of a strong dollar has materialized with the chronic increase of the US trade deficit. I was surprised about Baker's blaming of the Clinton administration and in this regard I thought that there couldn't ever be a single analytical reason to justify the ongoing economic depreciation of the dollar. In fact, I felt that the qualitative reason for the dollar depreciation was the greed of the crony capitalism of president George W. Bush's administration. However, we must also realize that crony capitalism has been galloping since the Reagan's era and it has reached its peak with the present Bush administration. This cronyism peak may be wrapped up at this time with the following facts:

The United States could have been a democratic and generous influence for the world and it wouldn't have cost anything for the United States as the US dollar could have maintained its international reserve currency. Instead, the Bush neocons wanted more, it wasn't enough for them to call the international shot, they had to use their hyper power to show the world they were the strongest and the meanest and they have been successful. The once generous US dollar has turned to a bloody dollar [6] which is further depreciating and which has lost its previous prominence as the international reserve currency [7]. Without any doubt the depreciating US dollar will be a main cause for the upcoming inflation in the United States. Today, I am perplexed when I realise that Canadians are demanding that prices of their goods and services be reduced to be in line with the lower corresponding prices in the United States [8]. Canadians need not to worry, the Canadian prices will somewhat level with the US prices, and that will be because of the US inflation [9] brought to you by the bloody dollar. It is really an upside-down world what we experience today; we have these hypocritical US cronies who preach democracy and yet, as in the case of Merrill Lynch's CEO Stanley O'Neal, when they write off billions of dollars of phony assets they are being 'kicked out' with a retirement package worth some 160 million dollars [10]. Then we have the Bush administration advertising the lowest budget deficit of $162 billion since 2002 and yet this same administration increased the national debt by $3 trillion [11]. Economist Weisbrot writes 'that the dollar is finally falling - it has dropped by 23 percent against a trade-weighted basket of currencies since February 2002', and yet U.S. Treasury Secretary Henry Paulson says 'I am strongly committed to a strong dollar[12].' And learn this: 'Treasury's Paulson wants faster China yuan rise .' [13] I explained sometime ago that a country is not strong by maintaining a strong dollar and that 'a country is strong when its people are strong, when its people are happy, when its people are at peace within themselves and with their neighbours. [14]' Instead, American cronies commodify the US dollar by preaching the policy of the strong dollar. Weisbrot explains that exchange rates must be flexible so that international trade deficits move back towards balance. He adds that ' the alternative to reducing the trade deficit through the dollar falling is to have a serious recession, which reduces spending on imports.' Without any doubt, the policy of a strong dollar has benefited many multinational companies as they moved their factories overseas and as they have been importing cheap goods and services. A strong dollar has benefited the banks and financial institutions by keeping inflation low and by creating the stock and housing bubbles. But this game of unsustainable strong dollar is over, the collapse of the stock market in the years 2000-2002 resulted in a $7 trillion of lost shareholder wealth [15] and now we have the potential collapse of the $8 trillion housing bubble. Yes, Dean Baker is right, the policy of the strong dollar initiated by the Clinton administration is the culprit of the present collapse of the dollar, and the policy of a strong dollar has been motivated by the unbound greed of American cronies, be it under the Clinton administration, be it under the Bush administration. That is, the policy of a strong dollar is the policy of unbridled greed. |

|||||||

|

|

|||||||

| References: | |||||||

| Baker, Dean "Down with the dollar," , November 5 , 2007, The Guardian http://commentisfree.guardian.co.uk/dean_baker/2007/11/down_with_the_dollar.html |

|||||||

|

|

|||||||

| Econbrowser "Borrowing short and lending long," September 6, 2007 http://www.econbrowser.com/archives/2007/09/borrowing_short.html |

|||||||

|

|

|||||||

| Progress Report "The Most Expensive Year of the War," September 26, 2007, Center for American Progress Action Fund , http://www.americanprogressaction.org/progressreport/2007/09/expensive.html |

|||||||

|

|

|||||||

| Whitney, Mike "Plummeting dollar, credit crunch..." September 18, 2007, Daily Times of Pakistan, http://www.dailytimes.com.pk/default.asp?page=2007%5C09%5C18%5Cstory_18-9-2007_pg5_22 |

|||||||

Baker, Dean "Midsummer Meltdown Prospects for the Stock and Housing Markets," August 2007, Center for Economic and Policy Research |

|||||||

| deSantis, Mario "The Bloody US Dollar of President Bush's New World Order," February 4, 2003, Ensign, http://www.ftlcomm.com/ensign/desantisArticles/2002_700/desantis747/bloodymoney.html |

|||||||

| Roberts, Paul Craig "The Wages of Hegemony," November 1, 2007, CounterPunch, http://www.counterpunch.org/roberts11012007.html |

|||||||

| CTV.ca News Staff "Flaherty calls on distributors to reduce prices," October 23, 2007, CTV News http://www.ctv.ca/servlet/ArticleNews/story/CTVNews/20071023/retailers_loonie_ 071023/20071023?hub=QPeriod |

|||||||

| Buchanan, Patrick J. "Sinking Currency, Sinking Country," November 1, 2007, www.buchanan.org http://buchanan.org/blog/?p=880 |

|||||||

| Associated Press "Merrill Lynch says CEO O'Neal to step down," October 30, 2007, MSNBC http://www.msnbc.msn.com/id/21489027 |

|||||||

| The Associated Press "US budget deficit falls to $162.8 billion in 2007, lowest level in 5 years," October 11, 2007, International Herald Tribune http://www.iht.com/articles/ap/2007/10/11/business/NA-FIN-US-Budget-Deficit.php |

|||||||

| Weisbrot, Mark "Who's Afraid of a Falling Dollar?", November 8, 2007, Center for Economic and Policy Research http://www.cepr.net/content/view/1355/45/ |

|||||||

| Somerville, Glenn "Treasury's Paulson wants faster China yuan rise," October 23, 2007, Reuter, Boston World News http://www.boston.com/news/world/asia/articles/2007/10/23/paulson_wants_faster_china_yuan_rise/ |

|||||||

| deSantis, Mario "There is such a thing as Disaster Capitalism Mr. Corcoran!" November 1, 2007, Ensign http://www.ftlcomm.com/ensign/desantisArticles/2007_943/desantis944/shockDoctrine.html |

|||||||

| American Shareholders Association "The Bull Market Came Roaring Back In 2003," 12/10/03, American Shareholders Association Stock Market Scorecard – http://www.atr.org/content/pdf/pre2004/121003asa-yearend.pdf |

|||||||

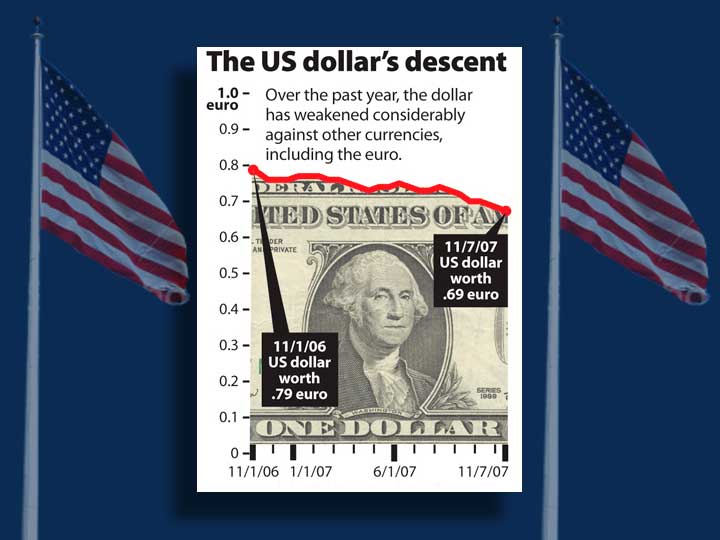

| Graphic's credit: the centre of the cover picture was borrowed from the Christian Science Monitor | |||||||

|

|

|||||||

|

|

|||||||