|

|

|

|

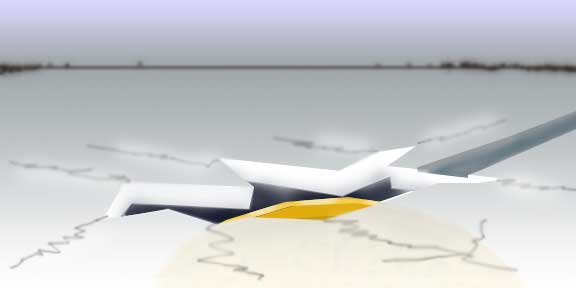

The Woes of The Canadian Dollar |

|

| Brandon - Monday, January 21, 2002 - by: Andrew Lane | |

|

investors |

Unfortunately we continue to look elsewhere to place blame for the woes of the Canadian dollar. Can't they see the underlying strength in our economy? Maybe it's what investors can see that is driving demand for the dollar down. |

|

|

|

|

Martin |

This past week in an appearance in Brandon (Manitoba) Finance Minister Martin told us that the dollar was not a concern. All would be well when economic uncertainty has passed. |

|

|

|

|

smart |

A more realistic view is that the smart money has seen Canada's inability to manage its economy and support long term growth -- and that investment is going into other countries. |

|

|

|

|

gambled |

The Federal Liberals opted to slash transfer payments for health and education in the early 1990 s to balance the federal deficit. They gambled, and won, that we would demand that this tax shift be repealed in the future. Presto, less than a decade later they send a few dollars more to the provinces in transfer payments and keep the great HRDC slush funds. Why earn votes by caring for the long term welfare of our nation when you can buy it with the taxpayers own money. |

|

|

|

|

pay |

There is a prescription to improve the dollar. Cut the pork barrel spending by government including subsidies to business (Government is notorious for not picking winners) or regional spending to maintain unity or to keep people in impoverished areas. Instead focus on paying down Canada s enormous $600 BILLION debt. |

|

|

|

|

real |

By showing commitment to fiscal management and eliminating the annual $42 BILLION in interest payments (around $10 BILLION out of the country) our federal government will position this nation for real growth. |

|

|

|

|

re-invest |

Not only will a stronger Canadian dollar allow business to re-invest in critical capital to keep Canada competitive but there will be opportunities for significant tax cuts as government spending will decline by more than one-third the equivalent of the current annual interest payments of the total federal budget. |

|

|

|

|

management |

There is a solution, however, we may need new management to get there. |

|

Andrew Lane |

|