|

|

|

|

Get ready for green peas and alfalfa sprouts taxation |

|

| Ottawa - Tuesday, June 18, 2002 - by: Walter Robinson, Federal Director, Canadian Taxpayers Federation | |

|

|

|

|

sponsorgate |

|

|

|

|

|

Budget |

But should they decide to think of Ottawa and politics, the future of taxation (think: Budget 2003) is worthy of some consideration. In short, this future will consist of green peas and alfalfa sprouts, or any other vegetable mom forced us to gulp down as a kids. And as we dutifully swallowed and grimaced in agony, mom would always say, “don’t make that face, it’s good for you.” |

|

|

|

|

flying |

Think back to the last federal budget. The feds imposed a new $12 one-way and $24 round-trip flying tax that took effect on, how appropriate, April Fool’s day. With flight volumes already back to pre-September 11th levels, experts are now predicting that this tax will rake in at least $3 billion annually instead of the $2.2 billion offered up in the budget tables. |

|

|

|

|

good |

This tax haul will flow directly into general revenues with no assurances that it will be spent on its stated purpose. But former federal Finance Minister Paul Martin assured that this flying tax was “good for us.” |

|

|

|

|

BC 15% |

Here’s another example: In 1997, the B.C. government introduced a 15% ‘surcharge’ on motor vehicle fines to finance a new ‘Neurotrauma Fund’ dedicated to research and prevention programs of spinal cord and brain injuries. The government even managed an appearance by man-in-motion Rick Hansen at the press conference to endorse the initiative. |

|

|

|

|

80% |

As it turns out, 15% of $66-million that the tax nets amounts to a cool $10-million. But the victims of neurotrauma see less than a quarter of it. The government only transfers $2-million to the fund annually, pocketing the remainder. |

|

|

|

|

make |

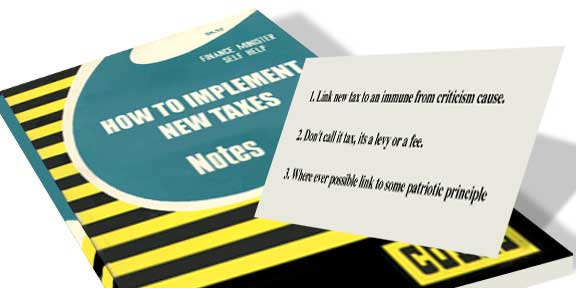

The Cole’s Notes version of the HOW TO IMPLEMENT NEW TAXES memo now circulating amongst finance officials across the country (in both official languages) goes something like this … |

First, link any new tax measure to a specific cause that is basically immune from criticism. Second, never call the new measure a tax, instead obfuscate by invoking terms such as ‘security fee’, ‘user pay’, and/or ‘dedicated levy’. And finally, if anyone (like those pesky taxpayer advocates at the Canadian Taxpayers Federation) dares to criticize the tax, boldly and indignantly wrap yourself in the flag of public good and accuse them of being against the specific cause that is immune from criticism … see point one of the memo. |

|

|

|

|

|

tobacco |

In Ontario, the government’s forthcoming budget will likely hike tobacco taxes. Just like the B.C. debacle described earlier, this tax hike will likely follow the points in the aforementioned tax hike memo to a tee. But there is no guarantee whatsoever that these new revenues will actually go into health care. |

|

|

|

|

junk food |

As health care reform remains topical, will we see more recommendations (like those being talked about in Nova Scotia) to tax junk foods for let’s say a ‘cardio-fund’ to combat heart disease? |

|

|

|

|

kindness |

Or how about municipal fines for these mean folks who don’t hold elevator doors open for you as you race through the lobby of your office building? It could called the ‘kindness levy.’ |

|

|

|

|

for your |

Maybe this is what Ottawa’s innovation agenda is really all about: finding innovative ways to raise taxes. Governments will become more cunning in how they dress up new taxes all the while nodding in grave concern and telling us it’s for our own good. So there you have it … green peas and alfalfa sprouts, the future of taxation. |

| Walter Robinson Federal Director |

|