|

|

|||||||

|

The “real deal” for Canadian cities |

|||||||

| Ottawa - Tuesday, May 20, 2003 - by: Walter Robinson, Federal Director, Canadian Taxpayers Federation | |||||||

|

urban and |

|

||||||

|

|

|||||||

|

fiscal |

Ensuring that our cities work is more than just an issue to be addressed before an election. With 80% of Canadians living in regions with 10,000 or more people and 60% of our 31 million people living in the countries six largest metropolitan regions, the fiscal health of our cities is vital to the national interest. | ||||||

|

|

|||||||

|

Toronto |

As much as we all dislike the self-anointed centre of the universe (aka Toronto), it accounts for over 20% of our annual $1 trillion GDP. Yet our cities are struggling to keep pace with demands for more roadway, transit and waterworks infrastructure just to name a few. | ||||||

|

|

|

||||||

|

core service |

By no measure are our cities perfect. All should conduct core service reviews to identify their key lines of business as opposed to the hodge podge of services and social engineering exercises many now deliver and pursue. As well public-private partnerships and alternate service delivery must be employed by our municipal leaders to a much greater extent than they are today. | ||||||

|

|

|||||||

|

gas |

However, the cities are key to our economic union. Making the economic union work is an area where Ottawa has a key role to play. The most direct and expedient way to do this is through returning the gas taxes it collects from motorists at the pumps back to the same regions from which they came. | ||||||

|

|

|

||||||

|

federal money |

Ottawa collects $4.8 billion in fuel taxes ($4.4 billion from gas pumps, $400 million from other sources) every year, yet it returns less than 3% of this amount — a paltry $119 million — to roadway construction and development via Transport Canada highway transfers. And 99% of this money is directed to Quebec and the four Atlantic provinces. From the western banks of the Ottawa River to the farthest tip of Vancouver Island, five provinces are all shut out of highway funding. It is truly an unconscionable situation. | ||||||

|

|

|

||||||

|

only 10% |

Even if one adds all of Ottawa’s so-called infrastructure spending (read: bocce ball courts, canoe museums, Shawinigan fountains), this amount plus the roadway transfers still accounts for less than 10% of all fuel taxes collected over the last decade of federal Liberal rule. | ||||||

|

|

|||||||

|

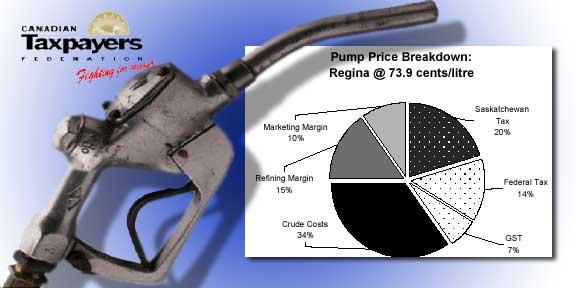

gouging |

It’s not big oil that is gouging us at the pumps, it’s big government. Federal fuel taxes increased by 500% between 1985 and 1995 going from 1.5 cents/litre to 10 cents/litre, with the last increase of 1.5 cents (from 8.5 cents to 10 cents) brought in by Paul Martin as a deficit reduction measure in his 1995. The deficit has been vanquished for almost six years, why does this surtax remain? | ||||||

|

|

|||||||

|

over |

With Ottawa poised to amass $70 billion in surpluses of over-taxation in the next five years, it’s time cut the federal gas tax in half. The remaining 5 cents/litre and its resultant $2.2 billion revenue haul should be plowed back into roads in Canada’s cities — both large and small. To this end, the Canadian Taxpayers Federation has developed a Municipal Roadway Trust model to facilitate this reinvestment in Canada’s cities. | ||||||

|

|

|||||||

|

stable |

The trust model would be renewable every three years and federal oversight for funds spent would be achieved through yearly audits by the Auditor General. Allocated gas taxes to roadway (new or existing) improvements — since gas taxes are a user fee on motorists — would provide cities with a stable funding base and allow them to devote collections from their property tax base to other infrastructure priorities. | ||||||

|

|

|||||||

|

Martin |

Last year Paul Martin promised a “new deal” for Canadian cities. It was a slick soundbite, but that’s all it was. The Canadian Taxpayers Federation Municipal Roadway Trust is the “real deal” for Canadian cities. Over to you Mr. Martin. | ||||||

|

Walter Robinson |

|||||||

|

|

|||||||