|

|

|||||||

|

A week of taxing news for working stiffs |

|||||||

| Ottawa - Thursday, July 3, 2003 - by: Walter Robinson, Federal Director, Canadian Taxpayers Federation | |||||||

|

more than |

|

||||||

|

|

|||||||

|

expense |

What’s with these high ranking officials wining, dining, flying and sleeping to the tune of six figures on the taxpayers’ tab? And how many more of them are out there? You can rest assured that expense account records Access to Information requests are now being filed by major news organizations with a vengeance, and of course, as is common practice, by the Canadian Taxpayers Federation. | ||||||

|

|

|||||||

|

perfect |

On Wednesday, Finance Minister John Manley showed us that his speechwriters were as good as his predecessor Paul Martin. His use of the phrase “the perfect storm” to describe the combined impact of a rising Canadian loonie (compared to the U.S. dollar), the SARS crisis in Toronto and a mad-cow scare in the West as the elements battering the Canadian economy was quite clever. | ||||||

|

|

|

||||||

|

House of |

But that’s where the entertainment and informational value of Mr. Manley’s speech to the Toronto Economic Club ends. It would have been better for Mr. Manley to deliver a proper spring economic update before the House of Commons Finance Committee earlier in June — complete with supporting charts, tables and projections — if he really wanted to give Canadians an complete picture of the state of the Canadian economy in an uncertain economic world. | ||||||

|

|

|||||||

|

spending |

His speech in Toronto was two parts partisan infomercial and one part economic overview. While it is good news that our books will be balanced for the sixth straight year, Ottawa’s record spending growth — 46% over nine years through to 2004 — is still twice the rate of inflation and population growth over this same period. It is definitely cause for concern. | ||||||

|

|

|

||||||

|

June 28th |

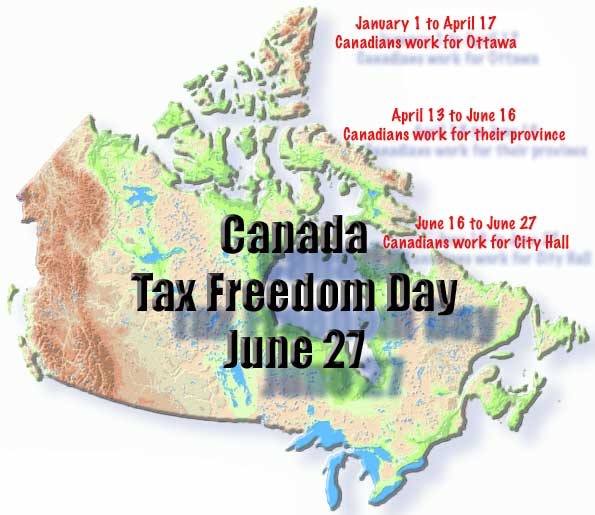

This growth goes a long way to explaining why this year’s national Tax Freedom Day, calculated annually by the Fraser Institute, occurs two days later on June 28th as opposed to June 26th in 2002. Tax Freedom Day measures the amount of taxes that Canadians play to all orders of government throughout the year. | ||||||

|

|

|

||||||

|

48.5% |

For 2003, the average Canadian family with a cash income of $73,718 will pay 48.5% of this income ($35,808) in various taxes including income tax, sales taxes, property taxes, import taxes, social security taxes, auto licence fees, etc. making the average family’s tax bill is up by $1,263 over 2002. | ||||||

|

|

|||||||

|

download |

Canadians can be forgiven for wondering what happened to all this income tax cuts over the past few years given the aforementioned data. While it is true that the federal and many provincial governments have cut income taxes by modest amounts, Tax Freedom Day nicely captures the downloading that has occurred right down to the municipal level and has manifested itself as higher property taxes, user fees, etc. | ||||||

|

|

|||||||

|

Working |

Looking at Tax Freedom Day another way, Canadians worked for Ottawa from January 1st until April 12th. After good night’s rest, they woke up on April 13th and worked until June 15th for the province and from June 16th until June 27th, they worked for city hall. | ||||||

|

|

|||||||

|

big |

Thank goodness Tax Freedom Day falls on a weekend … overtaxed Canadians deserve a rest. By contrast our American friends celebrated TFD on April 19th and our cousins across the pond in the U.K. “stopped workin’ for the man” on June 2nd. The lesson for taxpayers is clear: Big government in Canada is still a taxing reality. | ||||||

|

Walter Robinson |

|||||||

|

|

|||||||