|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Income splitting: errors and omissions acknowledged |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tisdale - Wednesday, March 12, 2008- by: Ken Styan | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

John; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Got to thinking about our phone conversation last Friday - you are aware that the "Income Splitting" only applies to PENSION INCOME (both CPP and company pensions - CPP is done separately by your request/instructions to the Government Human Resources - not when filing income tax) ? So this would not help you until Mary retires and commences to draw her pension. At that time she can split all, or part of her pension with you. This would move part of her taxable income into a lower bracket (i.e. from 22%, 26% etc. to 22% , 15% etc. Below are the 2007 rates; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

15% on the first $37,178 of taxable income, |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Example: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Mary's pension is $55,000.00 and yours is $30,000.00. Mary would pay 15% Federal Tax on the first $37,178.00; 22% on the next $17,822.00. ($37,178 x 15% = $5,577 + 22% on $17,822 = $3,921, for a total of $9,498 ($5,577 + $3,921 ). You would pay Federal Tax on $30,000.00 @ 15% = $4,500. Grand joint total $9,498 + $4,500 = $13,998.00. (Less Non Recoverable Tax Credits,medical, dental expenses, etc.). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

This is a rather simplistic explanation, as there are other factors that could or might impact on the end result. The politicians "blow smoke", stating ginormous savings; when in fact it really isn't a lot; unless you have one partner that has a very basic income; say $10,000.00 - $20,000.00, which allows room for a larger amount to be moved from a higher % bracket to a lower bracket. However; the politicians in their "We're great" propaganda, send out mailers proclaiming these large savings over the last couple of years since they've come to power, and quote dollar numbers. However; they usually combine the income tax savings with the GST Tax savings. They don't compare the Income Tax by itself. In fact; with the GST dropping (I think it has been dropped 2% in the last couple of years), you are talking about roughly $1200.00 GST savings for couple with a $60,000.00 joint income. (We pay GST on damn near everything!) So they can now proclaim that you saved $1697.00 ($497 + $1,200) in taxes since they have been in power. Now ; they are correct ; however, they mislead the average tax payer into thinking that their "INCOME TAX" has been reduced dramatically. When in fact a large part of it was due to the GST (which shouldn't even exist). Now; in all fairness, they have increased the Non Recoverable Credits a fair amount, along with the tax brackets. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

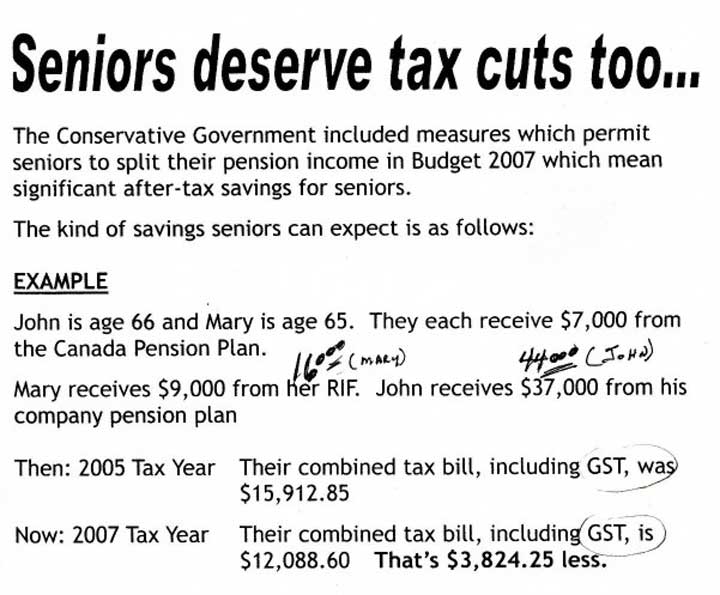

| I recently received a flier in the mail from our local MP (below), | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Wherein he states that John and Mary's "TAX BILL" for 2005 was $15,912.85 , including GST. In 2007, it was $12,088.60 , including GST (Difference of $3,824.25 !!). WOW! Now this could, perhaps be the case; however, given their income, the fact that they are retired and on pension (age credits) and accounting for the Non Recoverable Tax Credits and the tax rates in 2005 and 2007; without splitting income and without allowing for Medical or Charitable donations - they should have paid approximately $8,500.00 Federal and Saskatchewan Provincial income tax in 2007. In 2005; they should have paid approximately $9,000.00. (He doesn't state whether this is Federal and Provincial tax, or just Federal - we'll assume he means both.) Nevertheless; for 2007: $12,088 - $8,500.00 = $3,588.00 difference , and for 2005: $15,912 - $9,000.00 = $6,912.00. These differences can only be attributed to the GST. I have a hard time calculating how a family with an income of $60,000.00 could have paid $6,912.00 in GST. This equates to 11.52% on every dollar that came into their household ! Was GST ever this high? Or is our local MP "BLOWING SMOKE"? |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tax payable (without other deductions) $4,650.99 + $3,298.49 = $7,949.48 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

When you are completing your Income Tax Return, there is a lot more paper to shuffle than the above would indicate. Now this is a straight forward situation; not taking into consideration investment, savings interest, etc., etc. and other sources of income and deductions. However; I truly believe, that with a little bit of thought and ingenuity our public service people could devise a less complex and more proficient and paper saving system; without the "Computer and Telephone", as a large percentage of seniors don't feel comfortable with them. Strange - they proclaim the computer and telephone are more convenient and SAVE PAPER. Perhaps they should start saving paper by reducing the forms required to file your income tax. In regards to filing by telephone - tried it for my spouse's return a couple of years age. Now I like to believe I'm reasonably competent in reacting to instructions. Forget it - they more or less discontinued the call, as my input reaction was to slow. ( Didn't have anything to do with the fact that the instructions were almost unintelligible and extremely speed demanding - oh well guess I'm getting old and senile). Perhaps the government will allow me another NON RECOVERABLE tax credit. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

P.S. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| If you recall; a number of years ago we discussed the percent of Income Tax Canadians pay. If you look at John's situation (without consideration for possible other credits) , his income tax payable equates to $7,949.48 ÷ $44,000.00 = 18%. And if you combine John and Mary , the result is $7,948.48 (Mary pays little, or no income tax) ÷ $60,000.00 = 13.25%. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||