|

|

|

|

Maybe Not 35% |

|

| Tisdale - Thursday, January 17, 2002 - by: Ken Styan | |

|

|

Timothy; |

|

|

|

|

|

Read your article with interest, and although I agree with the general context; I am somewhat concerned about the accuracy of your statement; |

|

|

"most of us pay about 35% of our gross income to taxes" |

|

|

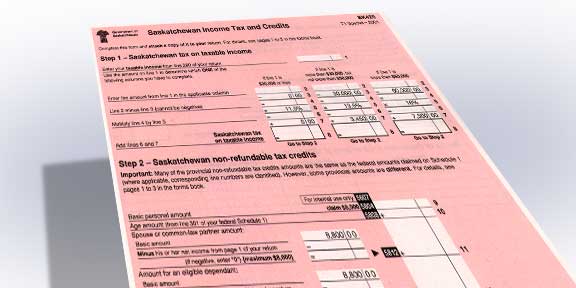

. I have never paid this rate and out of curiosity I completed a tax return, based on a two person family with one income of $50,000.00. I used only the Basic Personal Non Refundable Tax Credit for a husband/wife and their dependent spouse (No other Credits, such as Medical, Donations, etc., ). I arrived at 22.138%. Total tax payable (Federal - $6861.00 + Provincial $4218.00 =$11069.00) divided by Total income of $50,000.00 |

|

|

|

|

|

Further to this I quote Jim Stanford, Economist, Canadian Auto Workers |

"the total tax rate paid by truly middle income Canadians rarely exceeds 25 percent." |

|

|

|

|

Editor's note: I replied to Ken pointed out that I was in error, as I was only considering my own situation when last employed in a two income family when 35% was what we paid. But I also pointed out that when other forms of taxes were included it still is a very high percentage. Ken's reply is below: |

|

| Still disagree with you somewhat, in respect to Two income families versus One income families. (Depends on your total individual income ). As I stated in my earlier message, a Two person family with One income of $50,000.00 would pay 22%. If you split that income (Two person family, with Two incomes of $25000.00 each = $50,000.00 Total ), they each would pay $4770.00 or $9540.00 total , which equates to 19%. | |

| I guess the Feds in their infinite wisdom feel that the savings will pay for purchase , operation and maintenance of a second car, work clothes for two, rather than one, perhaps a baby sitter, whatever. | |

| I agree with the context of your article in general. I believe that in order to continue to benefit from one of the best (at least it was ) Health Care Plans in the world , we may be forced to pay more taxes. Now if an equalization formula were used wherein large corporations and business's were assessed on a level with the salaried employee , the increase might not be required , or a least it would be more palatable. | |

| Almost forgot; you are absolutely correct in stating that when you factor in the other taxes we pay,( property, Provincial Sales, G.S.T. & fuel taxes, etc. ) the 35% you quote is probably conservative. It would likely be in the 45% - 50% range! | |

| Ken Styan | |

| ------------------Reference: | |

| Reference: Jim Stanford article in The Progressive Economics Forum. | |