|

|||||||

|

(base image by Jim Cole, AP) |

|||||||

|

Bush’s ‘permanent tax cuts’ are creating bullish

bubbles: |

|||||||

| Nipawin - Friday - March 26, 2004 - by: Mario deSantis | |||||||

President George Bush |

|||||||

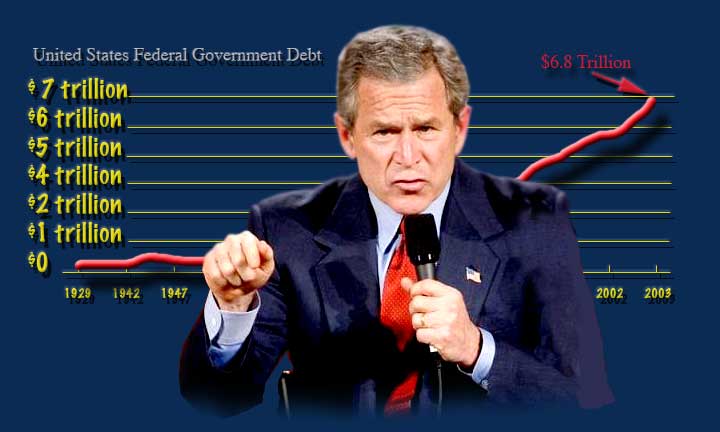

| In my last article on the anniversary of Bush war in Iraq I outlined the incompetence of the Bush administration in understanding terrorism and terrorists. The incompetence of Bush’s foreign policies has been covered up with the ideology of "you are with us or against us." At the same time, the consistent incompetence of Bush’s economic policies has been covered up with the ideology of "permanent tax cuts." | |||||||

| Bush’s ideologies can be summarized with what we commonly understand as the bullish behaviour of "my way or the highway." The bullish behaviour of the Bushes of this world is the culprit of our own social problem, of war, poverty, hunger, violence and terrorism. This bullish behaviour is intrinsic in the ideology of the Free Market, that is, freedom for the Bushes, but enslavement for common people at large. As Bush is incompetent in understanding terrorism, so he is incompetent in understanding our social and economic growth. | |||||||

| I express below some current concerns of Bush’s America in the hope, again, that our own thinking and understanding will help break down the myth of the insane ideology of "permanent tax cuts." | |||||||

|

|||||||

|

|

|||||||

| References: | |||||||

| The author, Mario deSantis, doesn’t subscribe to the use of econometric models in the area of broader economic public policies | |||||||

| White House Remarks by the President After Meeting with the Cabinet March 23, 2004 http://www.whitehouse.gov/news/releases/2004/03/20040323-5.html | |||||||

| deSantis, Mario One year after Bush’s war in Iraq: The building of the ominous ideology "you're with us or against us" March 23, 2004 Ensign | |||||||

| Weisman, Jonathan Link Between Taxation, Unemployment Is Absent (PDF) March 15, 2004 Washington Post, http://www.washingtonpost.com/wp-dyn/articles/A58658-2004Mar14.html | |||||||

| Center on Budget and Policy Priorities Tax

Cuts Are The Single Largest Way Policymakers Have Increased Deficits Revised

February 1, 2004 http://www.cbpp.org/1-28-04bud.htm |

|||||||

| Center on Budget and Policy Priorities TOO

GOOD TO BE TRUE: "Tax cuts don’t need to be paid for [with offsets] — they pay

for themselves." Revised March 22, 2004 http://www.cbpp.org/3-19-04tax.htm |

|||||||

| McLaughlin, Abraham As US cuts taxes, states hike

them: New York's $2 billion-plus tax hike is just the latest of several overhauls

that could recast the social safety net (PDF) May 28, 2003 The Christian

Science Monitor, http://www.csmonitor.com/2003/0528/p01s02-usec.html |

|||||||

| Fram, Alan Republican Still Think They Can Cut Taxes & Reduce Deficits(PDF) March 18, 2004 Associated Press, http://www.capitolhillblue.com/artman/publish/article_4250.shtml | |||||||

| DiMartino, Danielle U.S. Debt Burden Is Higher Now than During Depression, Study Says (PDF) March 15, 2004 The Dallas Morning News, http://www.miami.com/mld/miamiherald/business/national/8192892.htm | |||||||

| Reich, Robert B.In The Interest

Of Interest March 17, 2004 Marketplace®, http://tompaine.com/feature2.cfm/ID/10110 |

|||||||

| Weisbrot, Mark Is the Fed Playing Election-Year Politics? March 22, 2004 Knight-Ridder/Tribune Media Services, http://www.truthout.org/docs_04/032404I.shtml | |||||||

| McKenna, Barrie Low rates fuel fears in U.S.: Analysts

warn of asset bubble from hot housing market (PDF) March 20, 2004 The Globe

and Mail, http://www.theglobeandmail.com/servlet/ArticleNews/TPStory/LAC/20040320/RFED20/TPBusiness/TopStories |

|||||||

| Buttonwood Crude arguments: Markets should worry about the surging oil price (PDF) March 23, 2004 The Economist Global Agenda, http://www.economist.com/agenda/displayStory.cfm?story_id=2534075 | |||||||

| Baker, Dean Profits Shares Hit Record High In 2003: THE TAX

SHARE OF CORPORATE PROFITS IS NEAR ITS POST-WAR LOW (PDF) March 25, 2004 http://groups.yahoo.com/group/baker-data-commentary/message/163 |

|||||||

|

|

|||||||

|

|

|||||||