|

|

|||||||

|

|

|||||||

The Age of Turbulence Caused by the Money Changers |

|||||||

| Prince Albert - Monday - September 24, 2007 - by: Mario deSantis | |||||||

"We don't need a strong or a weaker U.S. dollar. What we need is just intelligent common sense"--Mario deSantis, Ensign, July 18, 2002 |

|||||||

On Friday (September 21) I learn that the pension fund Calpers, owned by the California state employees, has turned a $175 million of a 5.5 percent stake in Carlyle in 2000 into a paper value of $1.1 billion[1]. Carlyle is a worrisome business[2] and in this age of money making we have unions embedded with predatory businesses. It is consequential to understand that this is a world driven by the money makers, be unions or corporations or bankers or anything else, and not driven by intelligent common people.

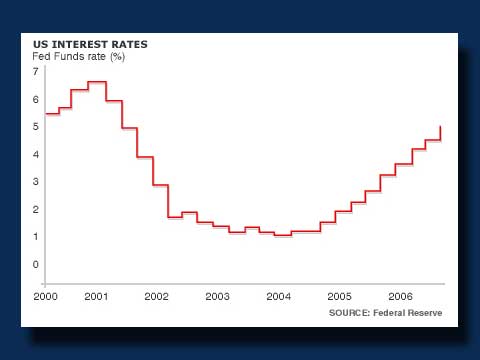

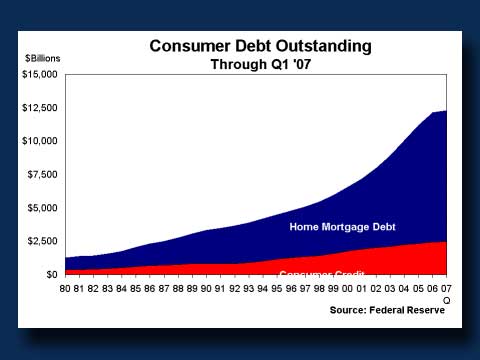

We are indeed in an age of turbulence and we must chase away the money changers from their high seats of civilization and replace them with common sense leaders. Financier Henry Liu has recently stated that " The conventional value paradigm is unable to explain why the market capitalization of all US stocks grew from $5.3 trillion at the end of 1994 to $17.7 trillion at the end of 1999 to $35 trillion at the end of 2006, generating a geometric increase in price earnings ratios and the like. Liquidity analysis provides a ready answer [6]."

At the same time as the money changers created asset bubbles so they engaged in two losing wars, Iraq and Afghanistan. Now these two phenomena, inflated money and wars, explain, at least for me, the redistribution of wealth of people which has occurred in the last 30 years from the bottom to the top[8], and especially the compensation of the top American CEOs[9][10]. We must learn to understand that we have limits to growth, limits to how much money we can make[11] and there must be NO WAR of choice[12]. In this regard I praise the unrelanted work by columnist Paul Krugman who has made his priority to address the politics and economics of inequality[13], the work of Dean Baker who periodically breakdowns the economic biases of our media financial gurus[14], and the work of Mark Weisbrot and of his staff who address the badly needed just foreign policies for the US government[15]. |

|||||||

|

|

|||||||

| References: | |||||||

| Sorkin, Andrew Ross Carlyle to sell stake to a Mideast Government, September 21, 2007 The New York Times | |||||||

|

|

|||||||

| Center for Media & Democracy, Carlyle Group, as seen September 24, 2007, SourceWatch http://www.sourcewatch.org/index.php?title=Carlyle_Group |

|||||||

|

|

|||||||

| Whitney, Mike "The Era of Global Financial Instability" ICH, September 21, 2007 Information Clearing House http://www.informationclearinghouse.info/article18437.htm |

|||||||

|

|

|||||||

| Greespan, Alan "The Age of Turbulence" September 2007 http://www.amazon.com/Age-Turbulence-Adventures-New-World/dp/1594201315 |

|||||||

Opinion editorial, Greenspan's bubble: Ex-Fed chief blind to own manipulations, September 18, 2007, Daytona Beach News-Journal |

|||||||

| Liu, Henry C.K. "Central Bank Impotence and Market Liquidity" August 24, 2007, Henry C.K. Liu web site http://www.henryckliu.com/page137.html |

|||||||

| Baker, Dean "The Housing Bubble Pops" , September 13, 2007 The Nation http://www.thenation.com/doc/20071001/baker |

|||||||

| Irvin, George "Growing Inequality in the Neo-liberal Heartland" (pdf) September 2007, post-autistic economics review, issue no. 43 http://www.paecon.net/PAEReview/issue43/Irwin43.pdf |

|||||||

| Anderson, Sarah and others, Executive Excess 2007, The Staggering Social Cost of U.S/. Business Leadership, (pdf) August 29, 2007, 14th Annual CEO Compensation Survey, United for a Fair Economy http://www.faireconomy.org/reports/2007/ExecutiveExcess2007.pdf |

|||||||

| Brush, Michael "War means a windfall for CEOs" September 19, 2007, MSN Money | |||||||

| Gardner, Howard "An Embarrassment of Riches" May/June 2007, Foreign Policy http://www.foreignpolicy.com/story/cms.php?story_id=3787 |

|||||||

| deSantis, Mario "The real axis of evil: President Bush & Privatisation" Ensign, May 25, 2004 http://ensign.ftlcomm.com/desantisArticles/2003_800/desantis896/evil.html |

|||||||

| Krugman, Paul "Introducing This Blog [Krugman's The Conscience of a Liberal]" September 18, 2007, The New York Times http://krugman.blogs.nytimes.com/2007/09/18/introducing-this-blog/ |

|||||||

| Baker, Dean, The Post has not heard of Global Warming either, September 24, 2007,Dean Baker's commentary on economic reporting "Beat the Press" The American Prospect http://www.prospect.org/csnc/blogs/beat_the_press |

|||||||

| Just Foreign Policies http://www.justforeignpolicy.org/issues/index.html |

|||||||

|

|

|||||||

|

|

|||||||

This week I have been touched by the slide of the American dollar, the fear of collapse of the US housing boom, of warnings of a world wide financial collapse, of an eventual coming recession in the United States[

This week I have been touched by the slide of the American dollar, the fear of collapse of the US housing boom, of warnings of a world wide financial collapse, of an eventual coming recession in the United States[ Common sense economist Dean Baker has written that

Common sense economist Dean Baker has written that